French income tax calculator

Cleartax software caters to the needs of all kinds of income tax payees such as individuals CAs or businesses. If you earn more you pay a bigger percentage of your income.

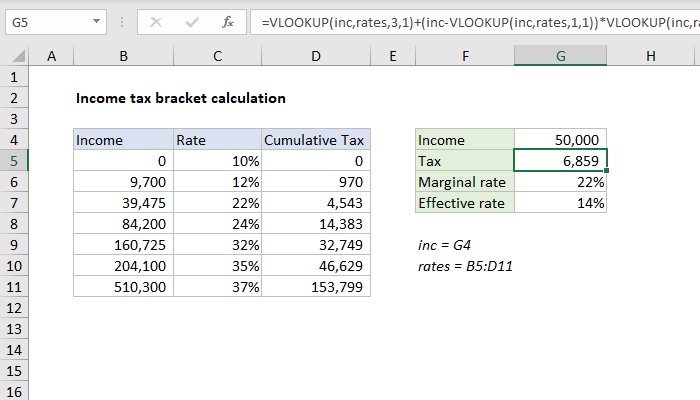

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial

After May 2 English and French hours of operation will be 9 am.

. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Sales tax is a tax that is paid to a tax authority for the sale of goods and services. We are global tax refund specialists with decades of experience in providing tax refunds.

The French government provides a tax calculator which helps you work out how much youll need to pay. To 6 pm ET Monday to Friday except holidays. Conventional IRA andor retirement income distributions.

In particular deviations might be observed when the gross salary input is too high or too low. Simply click on the year and enter your taxable income. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

School fees for dependents paid for by employer. A payroll tax holiday is a type of deferred tax liability that allows businesses to put off paying their payroll taxes until a later date. The definition of assessable covers the following.

The city of New Orleans is named after the Duke of Orleans a regent under Frances King. Income tax in Thailand is based on assessable income. It has a number of innovative features such as an automatic tax calculator business tax filing and refund status.

TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes. 401K loan balance after leaving employer and not paying the loan. 12 tax on.

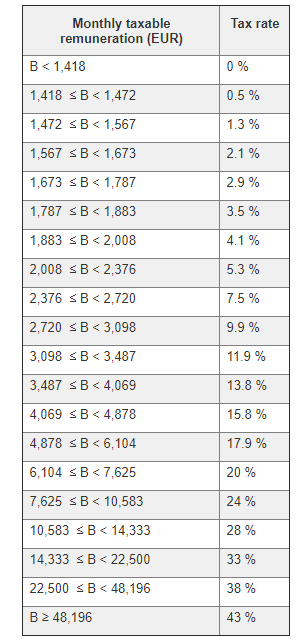

French income tax bands. Free Income Tax software available in the market 1. If you earn less than 10347 per year you dont pay income tax.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Find out your tax refund or taxes owed plus federal and provincial tax rates. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

There may be a slight differences. The calculator is based on the information available at the time of publication in January 2022 and is subject to change. The income tax formula depends on your tax class.

10 tax on people who live 184 days a year in the country. See Credit recapture next. The seller has the obligation to remit the tax to the proper tax agency within a prescribed period.

French is the second most widely spoken language in Louisiana. Income tax Einkommensteuer is a percentage of your income. A deferred tax liability DTL is a tax payment that a company has listed on its balance sheet but does not have to be paid until a future tax filing.

How Income Taxes Are Calculated. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Non-residents in France must pay income tax at a flat rate of 20 for earnings up to 27519 or 30.

Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. Sale andor abandonment of rental property. After May 2 English and French hours of operation will be 9 am.

The system will be ready for remittance of the Preschool For All Personal Income Tax on April 1 2021. Local retailer fees on winnings from 100 to 500. Refunds received after 2021 and after your income tax return is filed.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Income earned by a person who resided in Thailand for a total of 180 days. We have strong relationships with tax offices all over the world and always provide the highest legal tax refund possible.

ET for French during tax season from February 22 to May 2 2022. Your household income location filing status and number of personal exemptions. Income tax for non-residents in France.

Official Code 32-54101 et seq the Act and Mayors Order 2018-36 dated March 29 2018 hereby gives notice of the intent to amend Title 7 Employment Benefits of the. Its important to keep in mind that this tax calculator is meant to be an estimation of your tax burdern and not a precise number. The Director of the Department of Employment Services DOES pursuant to the authority set forth in the Universal Paid Leave Amendment Act of 2016 effective April 7 2017 DC.

30 tax on people who live less than 184 days a year in the country. Sales taxes can also be referred to as retail excise or privilege taxes depending on the state. This calculator forecasts your possible tax burden providing you with an estimate that you can use for research purposes.

The maximum income tax rate is 45 1. Our tax refund service is ISO 9001 certified due to our commitment to providing high quality customer service and 100 compliance. Sales tax is paid by the buyer and is collected by the seller.

ET for French during tax season from February 22 to May 2 2022. The tax holiday represents a financial benefit to the company today but a liability to the. Its a progressive tax.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. The impact on your paycheck might be less than you think. Income Tax on Earnings.

Wages paid in Thailand or abroad. While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. If anyone receives a refund after 2021 of qualified education expenses paid on behalf of a student in 2021 and the refund is paid after you file an income tax return for 2021 you may need to repay some or all of the credit.

Housing and meal allowances or their value. Your household income location filing status and number of personal exemptions. The median income tax rate is around 18.

Distributions from tax-deferred annuities calculated by the financial institution Airbnb income if space is used more than 15 days per year. Httpsproportlandgov_ For questions about the Preschool For All Personal Income Tax administration please contact the tax administrator at the City of Portland Revenue Division. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

Taxe D Habitation French Residence Tax

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

Getting A Tin Number In France French Tax Numbers Expatica

How Much Does A Small Business Pay In Taxes

What S The Tax Scale On Income Service Public Fr

Fr Income Tax Calculator August 2022 Incomeaftertax Com

French Income Tax How It S Calculated Cabinet Roche Cie

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

How To Calculate Foreigner S Income Tax In China China Admissions

Personal Income Tax Solution For Expatriates Mercer

Riverside County Ca Property Tax Calculator Smartasset

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

Sjcomeup Com Salary Calculator For France

Personal Income Tax Solution For Expatriates Mercer

How To Calculate Foreigner S Income Tax In China China Admissions

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com